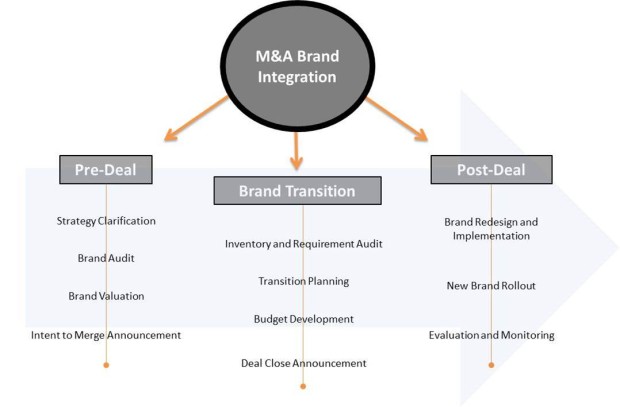

During my time leading marketing and brand strategy at Whole Foods Market, we integrated ten acquired companies and their brand names under the Whole Foods master brand. The six month M&A brand integration process was defined and implemented years after the initial mergers, thereby involving entrenched (and oft times, confusing and dissimilar) customer and employee perceptions and requiring extensive perception change management. Since then, I’ve advised several clients through buy- and sell-side M&A deals, helping them successfully navigate brand and executive transitions.

Unfortunately, brand integration is often an afterthought in M&A deals. Companies get caught up in the deal bidding and negotiating process rather than assessing potential conflicting brand or corporate culture issues and creating a blueprint for future valuation/growth.

Insufficient (or non-existent) M&A brand integration planning can have disastrous consequences including poor M&A financial performance and dramatically diminished future brand valuation. History suggests that the majority of M&A deals result in destruction of value. Unknown liabilities emerge.

For M&A to work — if you want to leverage a CAPABILITIES PREMIUM in M&A — the deal needs to: (1) enhance your company’s distinctive capabilities, (2) leverage your existing competitive advantages, (3) complement your internal innovation processes, and (4) take your company assets, business strategy, corporate culture, and customer/employee perceptions into account — PRE-DEAL.

Want to increase M&A success and ensure that BRAND is part of M&A pre-deal making and post-deal integration? Here are four tips:

1. Evaluate Potential Brand Reputation Impact, Pre-Deal

Successful M&A starts with an audit of current and potentially acquired brands pre-deal to determine how one brand might negatively or positively affect the combined brand portfolio or company reputation. Are new brands congruent with the acquiring company’s overall brand promise? What legacy internal systems and equity assets do the brands associated with the deal bring to the table? These questions among others require thoughtful analysis.

Conduct thorough brand due diligence pre-deal and you will prevent unexpected, insurmountable post-deal brand integration challenges.

2. Dedicate Resources to Manage Integration Planning

Consider appointing a full-time internal or external brand integration planning manager or partner during the M&A deal bidding and negotiating process, before the transaction finalizes.

Having key full time integration resources in place early in the process can mean the difference between success or failure of any M&A deal. Without strategic leadership accountability, post-merger brand integration is doomed to fail.

Give your integration team the responsibility of identifying the issues to be addressed and developing your brand integration planning template – including spelling out “non-negotiables”. Integration project managers can ensure that executives and employees of both the acquirer and acquired entities understand and are committed to the same goals and communicate the same message.

In the case of Whole Foods Market, our brand integration team included corporate HR employees, store team leaders, regional Presidents, regional marketing coordinators, regional art directors, store design engineers, and IT team members as well as a brand integration project manager, investor relations manager, customer service manager and public relations (PR) manager. The diverse, cross-functional team helped us circumvent potential gaffes in store operational changes and proactively manage multiple points of communication with quality assurance checkpoints.

3. Preempt Potential Brand Conflict Issues

Customers, employees, and even investors can be fierce and territorial during post-M&A brand consolidation. Executives need to clearly communicate the broad strategic purpose of the M&A deal to employees and investors, setting vision for the integrated brand portfolio (and unique individual brand assets). When it comes to customers, it is important to understand highly-charged emotional brand heritage and broaden customer perceptions of their invested brand while preserving aspects of the brand equity of the former entities. All three constituencies — customers, employees, and investors — need to feel involved.

At Whole Foods Market, we were lucky to have passionate, engaged employees coupled with clear visions and values to guide our post-merger brand integration process. In a company where vision and values aren’t well communicated to employees, you are likely to encounter pre- and post-deal brand integration challenges.

Employees help to define a brand. Engaged employees build strong brands. Thus, cultural integration goes hand in hand with post-deal brand integration. HR, PR, and Brand Integration project managers will need to work in tandem, addressing structural, political, and social variables. Awareness sessions and transparent internal/external communications can reassure employees and customers that pre- and post-deal brand integration won’t impact day-to-day business or their lives.

4. Create a 90-Day Post-Merger Transition Plan With Measurable Metrics

A well-managed post M&A transition plan provides a blueprint for future growth. Integration is the key to future valuation creation. During the first 90 days post-merger or acquisition, you need to verify due diligence data, gather additional intelligence information, create internal integration implementation teams, and identify/leverage internal integration resources.

Your post-deal plan should be carefully coordinated in order to ensure successful implementation. An effective plan will:

- align brand strategies,

- identify and thwart cultural integration challenges,

- facilitate communication/support during the transition for employees, customers, and investors,

- establish operational transition parameters,

- encourage and incentivize rapid decoupling of legacy internal systems,

- dedicate resources and assign accountability,

- identify “go-forward” initiatives and action plans,

- define desired end states,

- provide post-merger acquisition metrics such as EPS (earnings per share) accretive transactions value and EPS dilutive transactions value,

- create mechanisms to monitor, measure, and manage customer, employee, and investor perceptions.

When developing your brand integration plan, don’t forget to think creatively and use common sense. For instance, an acquired brand doesn’t always have to take on the brand name of the acquiring company.

At Whole Foods Market, we rebranded all acquired companies with one exception: a legacy brand (Mrs. Gooch’s) in Southern California. Local customers and employees were so invested in the Mrs. Gooch’s name that we permanently branded the La Jolla location in-store cafe as Mrs. Gooch’s to preserve the vested brand equity and recognize the brand’s heritage. It was a brand reputation win-win, for customers, employees, and investors. Ironically I now live in Southern California. Every time I drive past the Whole Foods / Mrs. Gooch’s Cafe sign I remember the value of arbitration and win-win M&A co-branding deal negotiation.

Research suggests that companies that fail to bring brand into early M&A discussions almost always under-perform deals that are forged with deliberate, pre-planned brand fusion strategies. Serial acquirers such as Microsoft, Google, Facebook, Oracle, OpenText, Cadence, T-Mobile, and Constellation Brands — along with companies in any consolidating industries such as telecom, medical devices, and oil/gas — could see huge advantages given systematic pre- and post-deal brand integration processes.

Proactive pre- and post-deal brand integration planning coupled with a sound implementation process can mitigate uncertainty, clarify the intent of the acquisition or merger to customers, employees and investors, and ultimately determine an M&A deal’s success or failure.

No Comments to “M&A Integration: How To Do It Right”